Law Firm Announces It's Investigating WWE Over Endeavor Sale

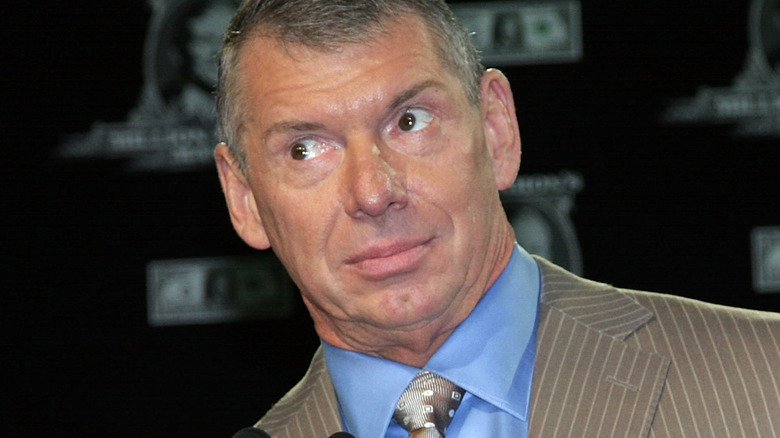

Vince McMahon's power grab to regain control of WWE already triggered legal action from shareholders in January, and now that he's shepherded the company into a merger with UFC, it looks like there's going to be more where that came from. On Monday, a few hours after the Endeavor deal was announced, law firm Ademi LLP issued a press release announcing that they were initiating their own investigation into the sale, looking for "possible breaches of fiduciary duty and other violations of law."

Ademi asserts that not only is WWE stock being valued too low in the merger, but also that "[t]he transaction agreement unreasonably limits competing bids for WWE by imposing a significant penalty if WWE accepts a superior bid." Additionally, it asserts that "[w]e are investigating the conduct of WWE's board of directors, and whether they are (i) fulfilling their fiduciary duties to all shareholders, and (ii) obtaining a fair and reasonable price for WWE."

This is not the first time that Ademi has solicited potential plaintiffs for a class action shareholder lawsuit against WWE. In May 2014, the firm went hunting for potential clients in light of McMahon's claims that WWE's newest domestic TV rights deals would double the previous rights fees. Most memorably, on the investors call discussing Q2 2013, McMahon told analyst Brad Safalow that if they didn't see a 100% increase, "I'll allow you to put a hammerlock on me." Instead, the increase was about 50%, and the difference sent WWE stock tumbling down.